The beta stage of any business is as critical as other stages. After and during the initial product development, businesses get to test their products with actual use cases and gather valuable feedback from users.

At this stage, the business is not live-it’s not open to the public, just a select few to test the products and give feedback. With this feedback, businesses at the beta stage can make necessary improvements before launching.

During this stage, excellent product research, development and tweaks can also help businesses build a community of early adopters and generate buzz around the product. This step can be significant for new businesses, as it can help them go live faster, establish a foothold in the market and gain traction with potential customers.

Titan’s MVP

Titan Xchange, the merchant under the spotlight in this piece, is at that stage. The cross-border remittance platform plans to go live soon with its product that helps individuals and businesses to facilitate cross-border pay-out.

To attract early adopters, Titan is leading with the cross-border pay-out product, which allows sending money out of Nigeria. In product terms, the cross-border pay-out would be Titan’s Minimum Viable Product (MVP).

“That’s what we’ve been trying to achieve. It’s been challenging building this from a technical perspective because we’re thinking about every user scenario, and we’re trying to make sure that we make this platform as easy as possible for our users to facilitate our transactions. It’s been challenging and interesting at the same time because we have some good user feedback. But there’s room for improvement as well,” said Ayodele Ejiofoh, Chief Executive Officer (CEO) and founder of Titan Xchange.

“So, we are focusing on sending money out of Nigeria. We’re going to incorporate both angles of the equation very soon, but we are launching our MVP with the first version, enabling you to send money out of Nigeria because I think that’s a bigger problem to solve than bringing money into Nigeria,” Ejiofoh said.

In truth, the main focus of players in the cross-border remittance space has been solutions on in-flows- money coming in from the diaspora and not money going out of Nigeria. This market focus fits the demand as Nigeria has a high remittance inflow. Nigeria’s remittance inflows remain the highest in Africa, with a recent projection of $20.9 billion for 2022 alone.

It’s different for remittance outflow out of Nigeria. For example, in the first half of 2022, the inflow to Nigeria was $10.11 billion compared to $23.3 million in the outflow. The contrast isn’t hard to believe. The number of people who migrate out of Nigeria continues to increase every year. The high rate of immigration, coupled with the poverty rate in Nigeria, sees the need for those in the diaspora to always send money.

Still, there’s a case we can make that some challenges have stifled remittance outflow, and also made businesses and individuals to perform transactions offshore which are not captured by data. These factors have caused a stark contrast in volume to that of inflow. Those challenges are what Titan Xhange wants to eliminate with its product.

“If you were to go through the banks, it’s extremely expensive and stressful. There are also so many bureaucratic processes that could prevent your transaction from being processed efficiently,” Ejiofoh said.

“A lot of times people go the old traditional Person to Person (P2P) route; do you know somebody that needs Naira (NGN) so I can give them Naira, and they can give my friend some Pounds?

“So in those situations, I want Titan Xchange to be in everybody’s mind when they need to send money for personal use. I need to give my sister $1000. Instead of thinking about how to send it, let me just download the Titan app, put in my sister’s account details, fund my Titan, wallets with NGN, and Titan takes care of the conversion for me,” Ejiofoh said.

B2C and B2B

The use case for Titan Xchange cuts across business and individual needs. For students who study abroad to pay for school fees and personal needs. The use case also covers businesses that want to pay their supplier, partners, etc. Titan has created a digital platform ( mobile app and web) where they want to interface with the users and allow them to move money at their convenience.

“For example, if you want to Japa (Nigerian slang for migrating to the diaspora), you must pay your school fees. That is the trend. You want to pay school fees in London, but how do you access forex to pay your school fees?

“Or you want to send money to a friend, or a friend is going to London or America, and you want them to buy you a pair of shoes; you have the account number, but you don’t know how to get money across to them, what would you do?

“For businesses, 90% of our users currently in our beta phase are businesses that import on a daily or weekly basis, and they need forex to keep their business going.

“So they want to pay for their supply in China. Everything that you use in Nigeria is imported, right? The clothes you wear before someone somewhere brings them into the country. And for someone to bring it into the country, they need forex. So the use case for business is that we provide the forex liquidity they need to facilitate their transaction on an ongoing basis.” Ejiofoh explained.

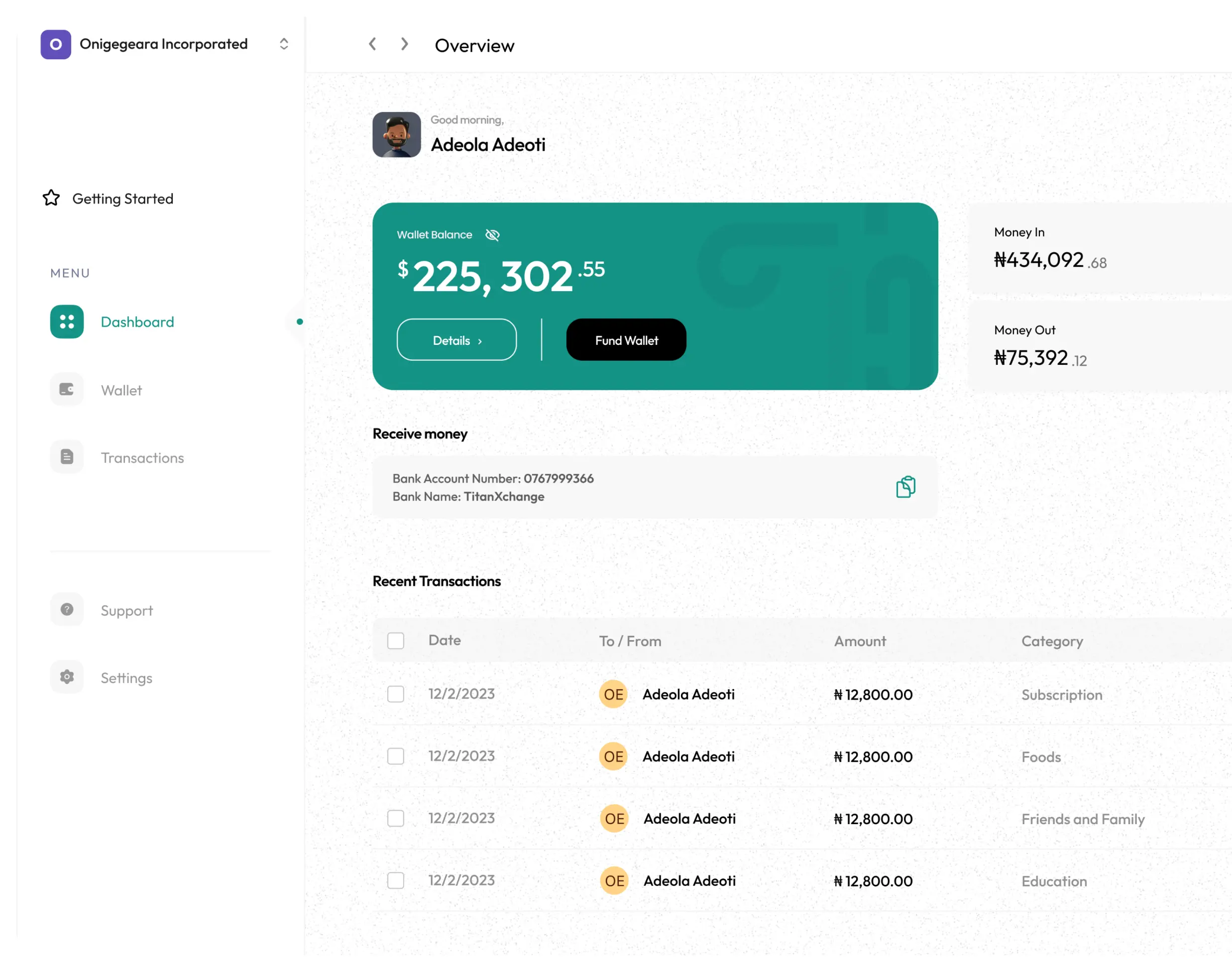

Using Titan Xchange is easy; users fund their wallets, attach their invoices, and provide beneficiary details, and the platform makes their transactions on their behalf.

Titan solves many challenges for the users; it saves them the headaches of passing through the bureaucratic mess of the traditional banking system, shields them from fraudulent acts that are popular in the P2P routes and gives them convenience while making these payments.

Users can access this service from Titan’s app or the web. Just create an account, submit their documentation for KYC purposes and then get a Virtual Wallet upon verification.

With NGN as its local currency Titan can power remittance into USD, EUR, GBP, and Canadian Dollars.

“We also have the capacity to cover others of African countries, like South African Rand Ghanaian Cedis. But just on our front end, we are currently supporting five currencies, NGN, USD EUR, GBP, and Canadian dollars,” Ejiofoh said.

Launching faster with Fincra

One way businesses at the beta stage, like Titan Xchange, can launch faster and better is by partnering with innovative businesses that can provide resources and expertise. In the payment space, Fincra is that partner that everyone needs, and Titan Xchange knows that.

“Fincra has been really useful for us; like extremely useful,” Ejiofoh said.

“First, to provide the infrastructure that enables us to receive the NGN. Fincra provides the infrastructure that allows us to automate our cross-border payment solutions to our users.

“Our users do not care how their backend works. It just happens, and they see their money. So, Fincra has been assisting us with paying out and receiving local currency.

Fincra has also been helping us facilitate other stuff, like, in terms of even just connecting us to investors.

“So yeah, it’s been a great experience with Fincra; the team is very responsive whenever I need to reach out to someone. They always come back with an answer to every problem.”

Conclusion

At Fincra, we saw a problem in the payment infrastructure space in Nigeria. We took up the challenge to build infrastructure that can allow the seamless transfer of value within the continent and with the rest of the world.

With what we have built and are building, we power businesses, large corporations, fintechs and everything in between with local and international payment solutions.

We have products that cover both the online and offline space, including Checkout, Virtual Accounts, Agency Banking, POS Terminal, APIs etc.

Like Titan Xchange, fintechs can leverage Fincra’s products and APIs to launch faster and offer financial services to their customers.

Create a free account with us or talk to one of our sales representatives for more details.