Introduction

The checkout process stands as a crucial point in the realm of e-commerce, marking the pivotal moment of payment.

The landscape of online commerce has continued to widen, offering unparalleled opportunities for businesses to reach global markets and providing consumers with unprecedented convenience.

However, this convenience also brings inherent risks, with cybercriminals constantly probing for vulnerabilities within online payment systems.

Therefore, prioritising the security of a secure system is important for online businesses, serving not only as a point of sale but also as the final safeguard against the exploitation of sensitive customer data by malicious entities.

In this article, we will dissect the details of establishing a secure checkout system for your business, shedding light on the evolving threats posed by cybercriminals, the indispensable measures that every business should adopt, and the cutting-edge technologies available to fortify your checkout process.

Evolution of checkout

The concept of checkout has long been intertwined with business transactions, predating the digital era.

In traditional retail settings, checkout denoted the stage at which customers conclude their purchases by tendering payment to cashiers, following the selection of items.

Throughout the years, numerous iterations of checkout mechanisms emerged in brick-and-mortar establishments, ranging from conventional cash registers to advanced barcode scanning technology and electronic point-of-sale systems.

The advent of e-commerce in the late 20th century introduced a new paradigm wherein customers could finalise transactions online.

This digital transformation also ushered in novel forms of checkout processes, encompassing digital wallets and cryptocurrency-enabled transactions.

However, along with these advancements came a slew of new threats, posing risks to businesses and consumers. Within the context of these evolving threats, the imperative for a secure checkout experience arises, necessitating proactive measures to mitigate risks and safeguard sensitive transactional data.

Forms of threat

The widespread adoption of e-commerce has given rise to many cybersecurity threats, including malware, phishing, data breaches, man-in-the-middle attacks, and DDoS attacks.

These threats, capable of overwhelming servers or networks, pose a significant risk to the security of online checkouts, rendering services inaccessible to legitimate users. Social engineering tactics further compound these risks.

Let’s delve into some of these threats for a closer examination.

Unauthorised access: Hackers can intercept payment information during transit, compromising customer data.

Payment card fraud: Stolen credit card details obtained through insecure checkouts can be used for fraudulent transactions.

Identity theft: Exposed personal information can be used to impersonate individuals or commit identity fraud.

Financial loss: Insecure checkouts can lead to financial losses for businesses and customers due to fraudulent activities.

Legal and regulatory consequences: Non-compliance with data protection laws and industry regulations can result in legal penalties and reputational damage.

Impacts on business

Having an insecure checkout poses huge risks to businesses.

Loss of trust: Customer data breaches erode trust and confidence in the business’ ability to protect sensitive information.

Damage to reputation: Negative publicity surrounding security incidents can tarnish the business’s reputation and deter potential customers.

Customer churn: Dissatisfied customers may take their business elsewhere, leading to revenue and market share loss.

Long-term consequences: Rebuilding trust and repairing reputation damage can be lengthy and costly, impacting the business’s bottom line.

Strategies to secure checkout

A secure checkout is the key to a successful online business, ensuring every transaction is safe, secure and fast.

These are some of the industry standard strategies to secure your checkout.

SSL encryption

SSL (Secure Sockets Layer) encryption is a standard security protocol that ensures a secure connection between a web server and a browser.

It encrypts data transmitted when a customer makes a payment to a business, ensuring that sensitive information such as card details, login credentials, and personal data is protected from interception by unauthorised third parties.

SSL encryption works by encrypting data using cryptographic algorithms, rendering it unreadable to anyone attempting to intercept it.

When you visit a website with a padlock icon and “https://” prefix in the URL, you have visited a website secured with SSL, ensuring that your browser and the web server have established a secure connection.

To get this on your website and protect your checkout, you must obtain SSL certificates from trusted Certificate Authorities (CAs) and install them on your web servers to enable SSL encryption. SSL certificates come in various types, including Domain Validated (DV), Organisation Validated (OV), and Extended Validation (EV), offering different levels of validation and security features.

SSL encryption will protect the data transmitted during online transactions, protecting customers’ privacy and preventing eavesdropping or tampering by malicious actors. It also helps build trust and credibility with website visitors by signalling that the website is secure and committed to safeguarding sensitive information.

PCI DSS Compliance

PCI DSS (Payment Card Industry Data Security Standard) is a set of security standards established by the Payment Card Industry Security Standards Council (PCI SSC) to protect payment card data and ensure the secure processing of payment transactions.

PCI DSS compliance is mandatory for businesses that handle card payments to safeguard cardholder data and prevent payment card fraud.

PCI DSS consists of twelve requirements organised into six categories: secure network infrastructure, secure payment card data storage, access control measures, regular monitoring and testing, and maintaining information security policies. Compliance with PCI DSS involves implementing security controls, conducting security assessments, and adhering to reporting requirements.

PCI DSS applies to all entities that store, process, or transmit payment card data, including merchants, payment processors, financial institutions, and service providers. Compliance requirements vary depending on the organisation’s transaction volume and the specific payment channels and systems used.

Compliance with PCI DSS is validated through various methods, including self-assessment questionnaires (SAQs), onsite audits conducted by Qualified Security Assessors (QSAs), and external vulnerability scans performed by Approved Scanning Vendors (ASVs). Non-compliance with PCI DSS may result in fines, penalties, and restrictions on processing payment card transactions.

HTTPS implementation

HTTPS (Hypertext Transfer Protocol Secure) is an extension of HTTP that incorporates SSL/TLS encryption to secure communication between a web server and a client (typically a web browser). HTTPS ensures that data transmitted between parties is encrypted, authenticated, and protected from interception or tampering by malicious actors.

Implementing HTTPS helps protect the confidentiality, integrity, and authenticity of data exchanged between a website and its visitors. It prevents unauthorised interception of sensitive information, such as login credentials, payment details, and personal data, thereby enhancing the security and privacy of online transactions.

To enable HTTPS on a website, businesses must obtain an SSL certificate from a trusted CA and install it on their web server. They also need to configure their web server to use HTTPS and redirect HTTP traffic to HTTPS to ensure all communication is encrypted. Additionally, website owners can use HTTP Strict Transport Security (HSTS) to enforce HTTPS usage and mitigate downgrade attacks.

Trust Indicators: Websites using HTTPS display a padlock icon and “https://” prefix in the URL bar, indicating that the connection is secure. Modern web browsers also display security warnings for websites that do not use HTTPS or have invalid SSL certificates, helping users identify potentially unsafe websites and protect themselves from cyber threats.

Secure passwords

Secure passwords protect user accounts, sensitive data, and online transactions from unauthorised access and cyber-attacks.

A strong password is difficult to guess or crack through brute-force attacks and incorporates a combination of uppercase and lowercase letters, numbers, and special characters.

Businesses should encourage users to create strong, unique passwords for their accounts and enforce password complexity requirements to prevent weak or easily guessable passwords. Additionally, businesses should implement password management policies, such as regular password rotation, password hashing, and password salting, to enhance security and mitigate the risk of password-related attacks.

Passwords are commonly used for user authentication in online systems, including e-commerce websites, banking portals, and payment gateways. Implementing multi-factor authentication (MFA) adds an extra layer of security by requiring users to provide additional authentication factors, such as a one-time password (OTP) sent via SMS or email, in addition to their password.

Businesses should educate users about the importance of creating and maintaining secure passwords and the risks associated with password reuse, sharing passwords, and falling victim to phishing attacks. Using password best practices and password management tools can help users protect their accounts and prevent unauthorised access.

Advanced security features

Aside from the strategies above, we also have advanced security features to help secure your checkout.

Tokenisation

Tokenisation replaces sensitive data, such as credit card numbers or personal identification information (PII), with non-sensitive placeholders called tokens. These tokens are randomly generated and unique to each transaction, making them useless to hackers even if intercepted.

When customers enter their payment information during checkout, the payment gateway replaces the card details with a token. This token then processes the transaction securely without exposing the card data to potential threats.

Tokenisation secures the transaction by reducing the risk of data breaches and unauthorised access to sensitive information. Even if attackers gain access to the tokenised data, they cannot decipher or misuse it without the corresponding encryption keys.

Businesses can implement tokenisation through Fincra. During integration, we configure our payment processing system to generate tokens for sensitive data securely and map them to the original cardholder information.

Multi-factor authentication (MFA)

Multi-Factor Authentication (MFA) adds an extra layer of security to the authentication process by requiring users to provide multiple forms of verification before accessing their accounts or completing transactions.

MFA typically involves combining two or more authentication factors, such as something the user knows (e.g., password), something the user has (e.g., mobile device or security token), or something the user is (e.g., biometric data).

MFA significantly reduces the risk of unauthorised access to user accounts and sensitive data, even if passwords are compromised. It provides an additional barrier against phishing attacks, brute-force attacks, and other common security threats.

Card Verification Value (CVV)

Card Verification Value (CVV) or Card Verification Code (CVC) is a three- or four-digit security code printed on payment cards (e.g., credit cards, debit cards) to verify card-not-present transactions.

During checkout, customers are prompted to enter the CVV/CVC code, which is not stored on the magnetic stripe or embossed on the card. Fincra’s payment gateway validates the CVV/CVC code with the card issuer to confirm that the customer possesses the physical card.

CVV/CVC verification adds an extra layer of security to online transactions by verifying that the customer can access the physical payment card. It helps prevent the unauthorised use of stolen card numbers obtained through data breaches or card skimming.

VV/CVC verification is enabled by default for most online payment transactions and is typically integrated into Fincra’s payment gateway’s checkout flow. Businesses can configure settings to require CVV/CVC input and customise response handling based on the validation results.

Fincra, the trusted payment gateway

The first and most important step in getting a secure checkout is to get the right payment gateway to power your checkout.

These are ways to know how our checkout stands out from the rest.

PCI DSS compliant

Fincra complies with industry standards such as PCI DSS (Payment Card Industry Data Security Standard) to protect sensitive payment data.

We have features like tokenisation and encryption to enhance security.

Multiple payment method

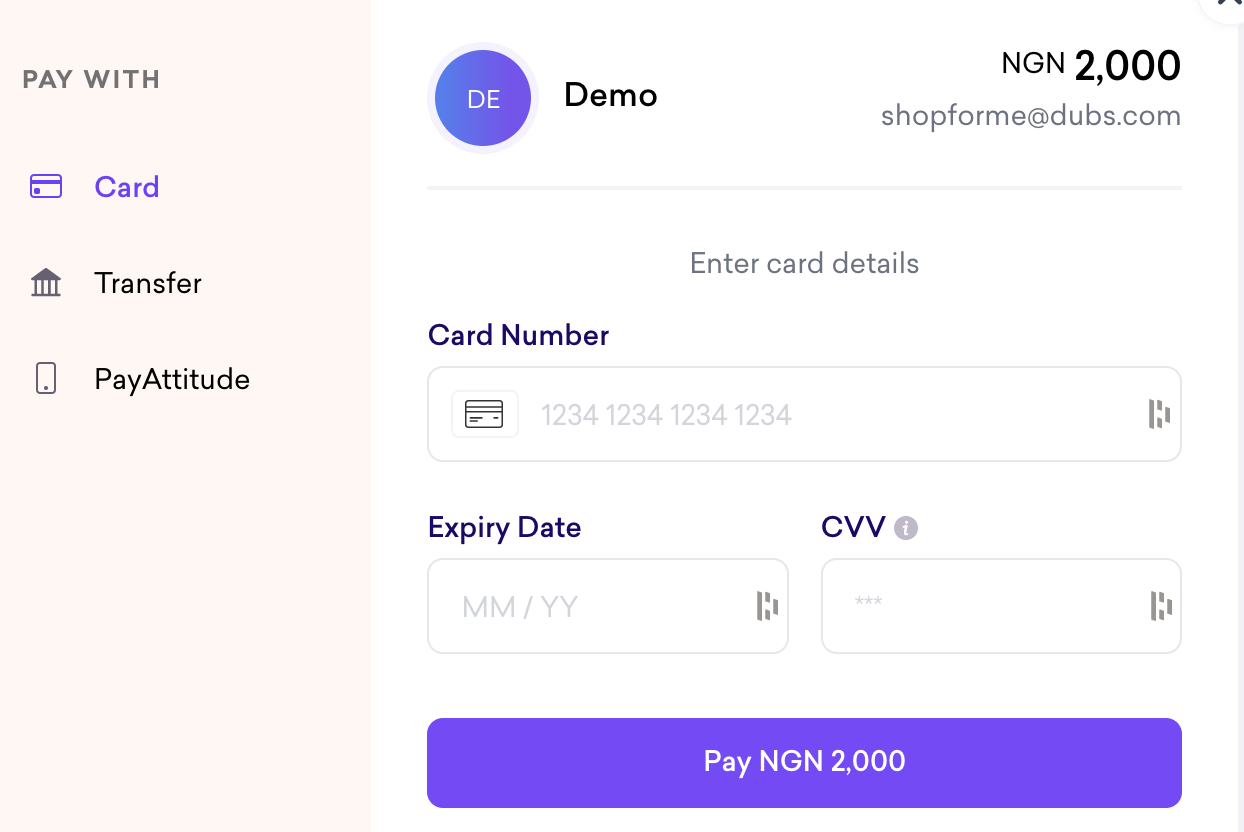

Fincra powers checkout through our embedded payment and payment link. These features create a checkout flow that supports various payment methods, including cards, bank transfers, and mobile money.

Integration Ease:

Fincra easily integrates with your existing website or e-commerce platform. We offer plugins, APIs, and SDKs for seamless integration.

Reliability and uptime

Fincra has a proven track record of reliability, uptime, and availability. It is built to handle peak transaction volumes without downtime or performance issues.

Customer support

Fincra stands out with our merchant success team’s exceptional support, quality and responsiveness.

Near 24/7 support with dedicated account managers and also enabling non-person support with online resources like our API documentation and help desk.

Customisation and branding

Fincra allows customisation of the checkout experience to match your brand’s look and feel. Businesses can customise payment pages, add logos, and personalise transaction emails.

How businesses can protect their checkout from fraud

We have been discussing what Fincra does to safeguard your checkout from fraud, but how about you? What responsibility should you have over the security of your checkout?

Fraud detection tools and services

Fraud detection tools and services are software solutions designed to identify and mitigate fraudulent activities within a business’s transactional processes. These tools utilise advanced algorithms, machine learning, and data analytics to analyse transaction patterns, user behaviour, and other relevant data points to flag potentially fraudulent transactions.

Fraud detection tools typically employ anomaly detection, behaviour analysis, and historical pattern-matching techniques to identify unusual or suspicious transactions. They generate risk scores or alerts based on predefined rules or machine learning models, enabling businesses to investigate and take appropriate action to prevent fraud.

By leveraging fraud detection tools and services, businesses can proactively detect and prevent fraudulent transactions, reducing financial losses, chargebacks, and reputational damage. These tools automate the monitoring process, enabling businesses to scale their fraud detection efforts efficiently and allocate resources to address high-risk transactions.

Businesses can integrate fraud detection tools and services into their payment processing systems or utilise third-party providers specialising in fraud prevention. Integration typically involves configuring rules, thresholds, and alert mechanisms to customise the detection process according to the business’s specific needs and risk tolerance.

Real-time transaction monitoring

Real-time transaction monitoring involves monitoring payment transactions to detect and respond to suspicious or fraudulent activity. This proactive approach enables businesses to identify and mitigate fraud promptly, reducing the impact on financial and operational stability.

Real-time transaction monitoring systems analyse real-time transaction data, assessing various parameters such as transaction amount, frequency, location, and user behaviour to identify anomalies or deviations from normal patterns. These systems employ automated algorithms and rules to flag potentially fraudulent transactions and trigger alerts for further investigation.

Real-time transaction monitoring enables businesses to detect and respond to fraudulent activities as they happen, minimising financial losses and reputational damage. By monitoring transactions in real-time, businesses can immediately prevent fraudulent transactions from being processed and protect both customers and the business from fraud-related risks.

Suspicious activity flagging and response protocols

Suspicious activity flagging involves identifying and flagging transactions or user interactions that exhibit characteristics indicative of potential fraud or security threats. Once flagged, businesses must have predefined response protocols to investigate, escalate, and mitigate the identified risks effectively.

Suspicious activity flagging systems use predefined rules, thresholds, and machine learning models to assess the risk associated with each transaction or user interaction. When suspicious activity is detected, the system generates alerts or flags and initiates predefined response actions, such as blocking transactions, escalating to fraud analysts, or triggering additional authentication measures.

Suspicious activity flagging enables businesses to proactively identify and respond to potential fraud attempts, reducing financial losses and protecting customer data. By automating the detection and response process, businesses can minimise manual intervention, improve response times, and enhance overall efficiency in fraud management.

Businesses should establish clear protocols and procedures for handling flagged transactions or activities, including escalation paths, decision-making criteria, and response actions. They should train staff members on fraud detection and response protocols and regularly review and update these procedures to adapt to changing fraud trends and regulatory requirements.

Educating staff and customers

Employee training on security best practices is essential for fostering a safety culture within the business and empowering staff to recognise and respond to security threats effectively. Training programs provide employees with the knowledge and skills to protect sensitive data, identify potential security risks, and adhere to security policies and procedures.

Employee training sessions cover various topics, including password hygiene, phishing awareness, data protection principles, secure remote working practices, and incident response procedures. Training materials may include interactive modules, videos, simulations, and real-world examples to engage employees and reinforce learning.

Customer education initiatives

Customer education initiatives aim to raise awareness among customers about potential security risks, privacy concerns, and safe online practices.

Educated customers are more likely to adopt secure behaviours, recognise phishing attempts, and protect their personal information, reducing the risk of security incidents and fraud.

Customer education materials cover topics such as password security, account protection, safe browsing habits, identity theft prevention, and recognising common online scams. Materials may be distributed through various channels, including email newsletters, website resources, social media posts, and educational events.

Conclusion

Prioritising security should be paramount for any business, and establishing healthy security practices is an essential initial step.

Fincra serves as a payment gateway committed to ensuring the security of its merchants, guaranteeing that transactions conducted through your checkout process remain thoroughly protected and secure.

Utilising Fincra, businesses can facilitate their checkout procedures via embedded payments on both websites and apps and through convenient payment links, enabling them to conduct sales across various online platforms, even without a dedicated website.

To enjoy the peace of mind that comes with secure transactions, create an account with Fincra today.