Introduction

Technology has tremendously impacted the pace of change in many aspects of our lives, enabling us to perform tasks faster and more efficiently.

Technology has automated several tasks, from communication to healthcare, transportation, entertainment and business, allowing us to optimise processes.

Adapting technology is critical to keeping up with the trends and staying competitive. Keeping up with trends is even more important in business to remain competitive and provide the best customer experience.

Keeping up with trends in payment processing is one of the key strategies in staying alive for retailers. In this piece, we will look at five key payment processing trends retailers must adopt in 2023.

By staying up-to-date with these trends, retailers can ensure they provide their customers the best payment processing options, ultimately driving growth and success for their businesses.

1. Mobile payments

Mobile payment means using mobile devices, such as phones, tabs, etc., to make payments.

Africa’s massive youth population has taken to mobile technology, and it makes sense for your business to take advantage of that. The World Bank and African Development Bank report that there are 650 million mobile users in Africa, surpassing the number in the United States or Europe.

Retailers must take this widespread use of mobile technology to their advantage with, for example, exceptional POS Terminals that accept more than just cards.

Fincra offers POS Terminals that enable retailers to optimise their payment processing for brick-and-mortar stores.

With our POS Terminal, brick-and-mortar retailers can allow their customers to pay with bank transfers from their mobile devices. This transfer method differs from regular bank transfers, which makes a customer wait for a manager to confirm the transaction. With Fincra POS Terminal, the translation is completed instantly with a receipt printed as a confirmation.

For retailers, this provides a faster checkout experience, which can reduce wait times and improve customer satisfaction.

Payments in this form can also eliminate or reduce the risk of fraud and chargebacks. Also, the benefits are numerous for customers. Mobile payment technology ensures they can quickly pay and complete shopping without cash or cards.

Mobile payments make transactions more convenient and secure and provide a better shopping experience.

2. E-commerce

The trend of buying and selling online has surged with the wild adoption of internet technology in Africa. According to the International Trade Administration, Africa will surpass half a billion e-commerce users by 2025.

Taking advantage of this to expand sales and increase growth, retailers must take their business to the internet to reach more customers. To do this, they must also meet the needs of online businesses, which include online payment processing.

Online processing in 2023 involves partnering with a payment processor like Fincra to optimise your payment.

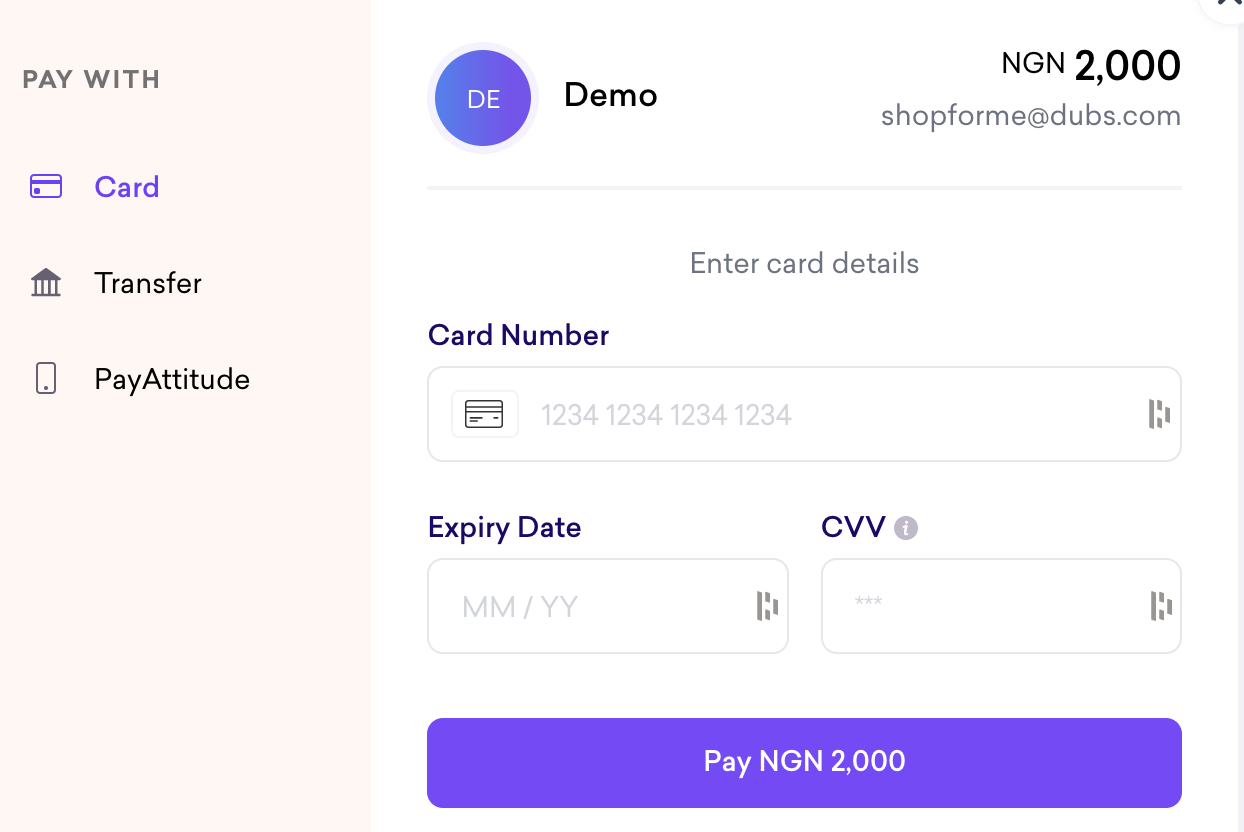

Fincra has Checkout that allows businesses to receive payment through cards, bank transfers, Mobile Money and PayAttitude, giving customers more flexibility and choice in paying for their purchases.

Fincra Checkout allows retailers to collect payments while selling online seamlessly. The Checkout flow also comes via Fincra Payment Link, which can enable retailers to sell online without a website to host the payment page.

With Fincra Payment Link, businesses can sell through different channels online like emails, social media and messaging platforms.

This feature allows retail businesses to meet customers, sell to them and complete transactions anywhere on the internet.

One of the key benefits of e-commerce payment processing solutions for retailers is the ability to accept payments from customers worldwide.

Fincra’s Virtual Account allows businesses to transact in different currencies enabling them to expand their customer base beyond their local market and reach a global audience.

Fincra POS Terminal is also beneficial for retail businesses that sell online for payment after delivery. With this terminal, your dispatch, agent or salesperson can quickly complete in-person transactions by allowing customers to pay with their cards or bank transfer.

In addition to all these benefits, Fincra also helps retailers with protection and dispute resolution services, which can help them reduce the risk of fraudulent transactions or chargebacks.

For customers, e-commerce offers a convenient and secure way to shop online. To foster loyalty with these customers, retailers must optimise the payment process to boost their experience. Doing this can help retailers to retain customers and drive growth sales.

3. Subscription payments

Subscription payment models allow customers to make recurring payments automatically to continuously access a product or service.

This payment model is becoming popular among retailers because it gives a certain level of guarantee to sales and revenue and increases customer loyalty. With recurring payments, retailers can predict their revenue streams and plan accordingly.

The subscription model of payment removes the decision-making for customers on an ongoing basis, which means that they get to pay for a product or service before they have time for a rethink. However, retailers must always keep their promise of exceptional products and services.

For customers, convenience is their goal, and subscription payments ensure they don’t have to input card details or payment information before completing a transaction.

4. Cryptocurrency payments

Cryptocurrency has gained popularity in Africa, although not for payments. Trading and investments are the most popular use cases for cryptocurrency in Africa, but retail businesses can still position themselves for when a shift happens.

There have been ongoing efforts to increase the use of cryptocurrencies for payments in Africa. The likes of Quidax, Bitpesa, Bundle Africa, etc, are working on developing payment systems that use cryptocurrencies in Africa.

5. Contactless and biometric payments

Although contactless and biometric payments have surged in developed economies worldwide, Africa has yet to see much adoption of these types of payments.

Contactless payment is the method that allows customers to make purchases by waving or tapping their payment card or mobile device over a terminal. Biometric payment technologies use unique biological characteristics, such as fingerprints or facial recognition, to authenticate a customer’s identity and authorise payment.

These technologies are becoming increasingly popular as consumers demand faster and more secure payment options.

These payments are the next frontier in Nigeria, where the recent Naira notes scarcity and the subsequent collapse of bank infrastructure frustrated payment processing for retailers.

Retailers must partner with a trusted payment technology partner like Fincra that can help them implement the latest technology in payment processing.

Conclusion

Sometimes, tiny details determine whether a business survives or stays competitive at these times. Keeping with trends is among one of those little details.

For payments, retailers must keep up with these five trends to stay competitive and drive sales growth. These payment forms can help retailers increase customer experience and boost loyalty.

Doing it alone is hard, so retailers need the best partners. Fincra is a payment partner that can help retail businesses to implement the latest technology to optimise payment.

Leave payment to us and focus on other aspects of business growth.

Create a free account with Fincra today, or speak to one of our reps to get started with us.