Introduction

The FMCG sector in Nigeria and Sub-Saharan Africa is currently grappling with notable challenges. These regions face a macroeconomic environment characterised by formidable factors such as rapidly rising inflation, high energy costs, elevated interest rates, and declining consumer purchasing power.

Additionally, FMCG businesses are also contending with the impact of technological advancements and shifting consumer preferences, all of which have significant implications for cash flow.

FMCG companies need to adjust and improve their payment collection procedures to succeed amidst these challenges.

Given the perishable nature of FMCG products, it is of utmost importance for businesses in this industry to swiftly sell their inventory to prevent wastage caused by spoiled or expired goods. Enhancing payment processes is crucial in maintaining a high turnover rate for these products.

This article will delve into five efficient methods FMCG businesses can employ to manage payment collection, enhance customer satisfaction and streamline transactions.

Cash payments

A McKinsey report titled ‘Future of Payments in Africa’, published in September 2022, confirmed that cash continues to dominate as the preferred payment method in Africa.

However, there are anticipated changes in consumer behaviour soon. However, until that transition occurs, FMCG businesses must recognise that cash remains a widely accepted payment option.

Therefore, FMCG businesses should be willing to accept cash payments from customers who have yet to embrace electronic and digital payment methods. FMCG businesses establish robust protocols for handling cash, including implementing secure cash registers and establishing secure storage facilities to ensure precision and minimise theft risk.

Card payments

With the rising adoption of cashless technologies among Nigerians and sub-Saharan Africans, card payments have emerged as one of the most popular choices.

Nigeria, in particular, boasts one of Africa’s largest payment card markets, with point-of-sale (POS) transactions leading the way. FMCG businesses must offer card payment options to cater to a broader customer base to capitalise on this trend,

This is where POS Terminals play a crucial role. Fincra offers a reliable POS Terminal solution explicitly designed for in-person transactions, catering to the needs of FMCG businesses. This solution enables businesses to securely accept card payments and process transactions while adhering to relevant industry standards.

Through our POS Terminal solution, Fincra can develop payment processing software and design the operating system and hardware applications, facilitating seamless payment experiences for businesses. We can also provide physical terminals for conducting transactions.

Pay with transfer and Virtual Accounts

Additionally, ‘Pay with transfer’ has gained popularity for offline transactions and situations where customers do not have cash or cards readily available.

Many Nigerian businesses rely on traditional bank accounts to collect payments through transfers, although this method often results in longer customer wait times due to the need for payment confirmation.

With Fincra’s POS Terminal solution, businesses can swiftly collect payments through ‘pay with transfer’, and the POS terminal instantly confirms the transaction by providing a receipt.

This process is easy, fast, and convenient for customers in retail settings. Fincra also offers virtual accounts, enabling businesses to receive such payments securely and efficiently.

Online payments

Establishing a robust online presence has become essential for FMCG businesses in the current digital era. The internet has revolutionised how we conduct business, and e-commerce platforms have opened avenues to reach a broader customer base while offering convenient online shopping experiences.

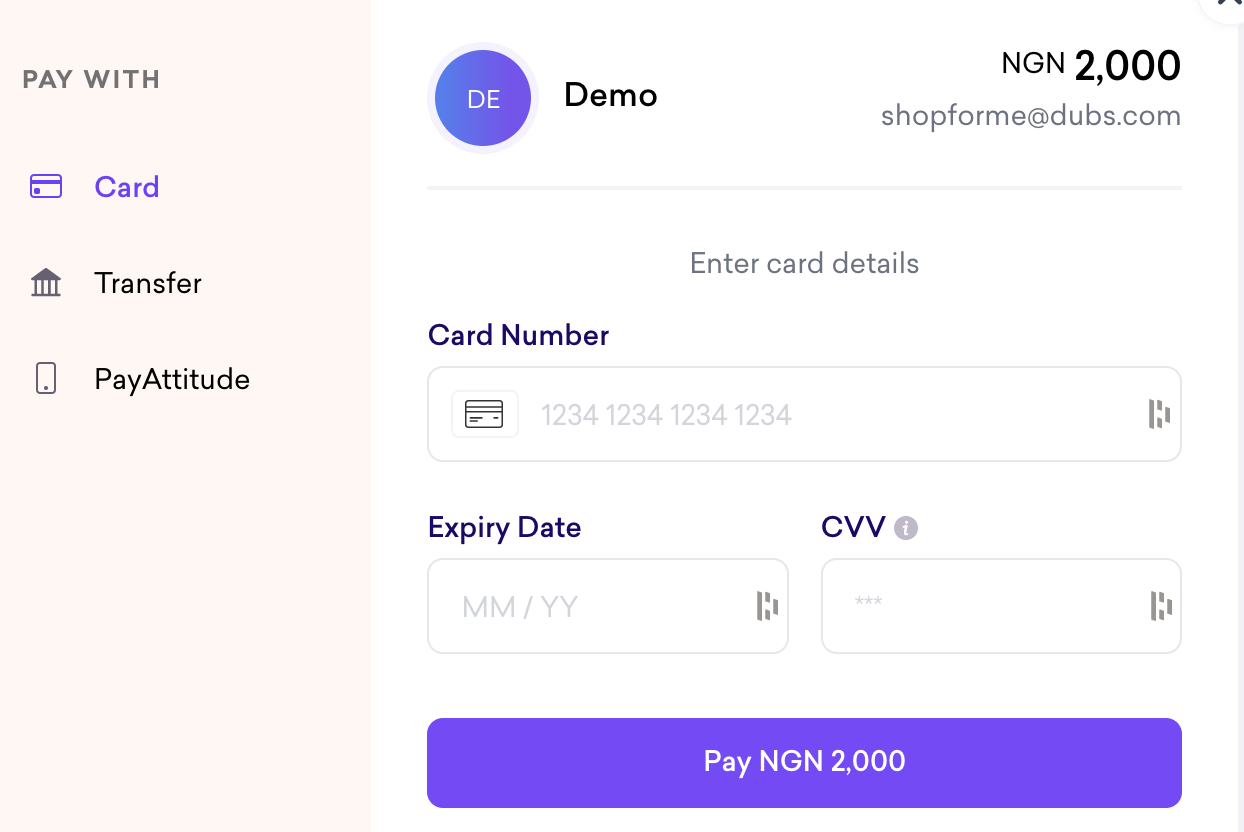

Businesses must integrate secure payment gateways to cater to these online customers effectively. Fincra provides a reliable payment gateway that enables businesses to seamlessly collect payments through various channels, including cards, pay with a transfer, Mobile Money, and PayAttitude.

E-commerce is not that complicated and mustn’t have to be with website. Businesses can sell and collect payments on social media and messaging platforms with Fincra’s Payment Link.

Conclusion

Keeping abreast of the latest payment trends is crucial for the survival of any business, and Fincra offers a range of payment options to meet the diverse needs of businesses and their customers.

Take the first step towards leveraging these benefits by creating a free account with Fincra today. Get started and unlock the potential of a robust online payment system for your business.