Introduction

Once upon a time, traditional banks held the primary responsibility for managing all business payment requirements. However, these banks had their limitations.

Fortunately, technological advancements have introduced improved alternatives. One such alternative is virtual accounts, which have gained popularity recently.

In this article, we will delve into the characteristics, advantages, and disadvantages of both traditional physical accounts and virtual accounts.

By understanding these aspects, businesses can make informed decisions regarding the type of account that best suits their specific needs.

Virtual Accounts

Virtual accounts are online/virtual bank accounts with the features of a traditional bank account. Virtual accounts function like traditional bank accounts and are digital or online-only banking solutions that enable individuals and businesses to manage their finances without needing physical branches.

Benefits of Virtual Accounts

Virtual accounts offer a range of benefits that make them a better option for individuals and businesses.

Convenience and accessibility

As a digital asset, virtual accounts provide consumers with convenience and accessibility.

Its 24-hour availability means that customers can access their accounts and manage their finances anywhere in the world with an Internet connection.

This accessibility cuts the inconvenience of bank visits and allows users to conveniently receive payments, conduct transactions, and check balances.

Enhanced transaction speed and efficiency

The advancement of technology has brought about several benefits, including increased speed and efficiency.

These several benefits also apply to payment methods with the emergence of new technologies such as virtual accounts. Virtual accounts enable people to conduct transactions swiftly and efficiently.

These virtual accounts have become incredibly versatile, facilitating various use cases, from fund transfers to bill payments. As a result, virtual accounts have significantly enhanced the speed and efficiency of payment processes in today’s world.

Lower fees and cost-effectiveness

Virtual accounts present a cost-effective alternative to physical accounts, as they often come with lower associated expenses.

Fintech companies or neo-banks that offer virtual accounts refrain from imposing exorbitant fees for monthly maintenance, ATM withdrawals, or transactional activities.

By streamlining their operations, virtual account providers can offer more affordable banking services, cutting down on expenses in running their business.

As a result, individuals opting for virtual accounts can enjoy cost savings while still accessing the necessary banking services they require.

Advanced security measures

As mentioned earlier, the enhanced technology that powers virtual accounts also prioritises security by employing advanced encryption technologies and robust security measures.

Measures like two-factor authentication, secure login procedures, transaction limits, and real-time transaction monitoring ensure that accounts are secured against suspicious activities.

Innovative digital tools and services

Virtual account providers often add innovative digital tools and services to improve customer experience.

Tools and services like budgeting and expense tracking apps, spending analytics, automated bill payments, and customised financial reports power users to manage their finances better.

Businesses can use these tools and services to get better insights into their customers’ buying patterns and make informed decisions.

Physical accounts

On the other hand, physical accounts are traditional bank accounts offered by brick-and-mortar banks and financial institutions.

Physical accounts require in-person bank visits to open and maintain accounts using physical elements such as physical checks, cash and cards.

Advantages of physical accounts

We have listed a host of the benefits of virtual accounts; now it’s time for the physical accounts.

Personalised service and human Interaction

Traditional banks and financial institutions have the advantage of having that physical touch in human interactions.

Customers/users visit banks and interact face-to-face with bank staff and relationship managers.

The personal touch is precious for individuals who prefer direct communication and personalised assistance.

Sense of security and trust

The physical touch we mentioned earlier gives customers and users a strong sense of security and trust.

When it comes to personal finances, individuals often develop a deep attachment and prefer seeing the people they trust handling their money. This advantage is particularly evident in physical accounts.

A physical bank branch plays a significant role in instilling a sense of security and trust. Customers feel reassured knowing they can visit a physical location and interact face-to-face with bank representatives. This tangible connection reinforces their belief that their money is in safe hands.

This is precisely why legacy businesses and customers, especially those from older demographics, have remained loyal to physical accounts and traditional financial institutions.

The familiarity and comfort associated with physical branches and the opportunity for in-person interactions have cultivated a strong sense of trust and reliability among these individuals.

Cash handling

Another reason why a lot of businesses have stuck with traditional banks and financial institutions is because of their experience in cash management.

As Nigeria and most of sub-Saharan Africa still relies on cash, businesses and individuals can deposit or withdraw some money conveniently, access cashier services, and utilise other in-person banking facilities.

Businesses in retail, where they still get a lot of cash payments, often use traditional banks.

Broad coverage

Traditional banks and financial institutions often have extensive branch networks which power their physical accounts suitable to local markets and purposes.

Trust in familiarity

People trust familiarity, and traditional banks and financial institutions offer that with physical accounts.

Many people have become used to traditional banks and physical accounts, which have built familiarity over the years.

Physical accounts offered by traditional banks and financial institutions have the advantage of this familiarity that people trust.

Factors to consider before choosing

Now that we have broken down the concept of virtual and physical accounts, it is essential to understand how to choose the one that is best for your business.

When deciding to use either a virtual account or a physical account, business owners should consider these factors;

Transaction volume and complexity

Transaction volume and complexity are factors to consider when deciding on the type of account to use.

Virtual accounts are the best for businesses with a high volume of digital and international payments.

Businesses with a local presence where cash is king can go with physical accounts and work with traditional institutions with experience and expertise in cash handling and management.

Geographic considerations

With virtual accounts, businesses can sell anywhere, irrespective of location. With a virtual account, a business can receive payment from customers anywhere.

E-commerce businesses and financial institutions that serve customers from anywhere in the world can use virtual accounts.

Physical accounts can be advantageous if your business primarily operates locally, as they offer access to branch services and local banking relationships that may be valuable for regional business needs.

Security and fraud prevention

Providers of virtual and physical accounts both have security and fraud prevention measures suited for businesses.

Virtual accounts employ advanced security measures to safeguard your business’s financial data and transactions. These include encryption, multi-factor authentication, and real-time transaction monitoring.

Physical accounts offer the advantage of physical document handling and resolving issues in person. This may provide additional security for businesses that operate large financial transactions or have specific security requirements.

Cost-effectiveness

Businesses that want to spend less on bank charges and account maintenance fees can cut costs with virtual accounts.

Physical accounts come with higher maintenance fees and transaction charges, although businesses might get specific benefits catering to their needs.

How to choose between virtual and physical bank accounts

Choosing between virtual and physical accounts for your business involves careful consideration of your needs and priorities.

Businesses have to weigh the pros and cons of virtual and physical accounts based on their needs.

Getting advice from financial professionals or business advisors is also necessary for businesses.

Hybrid solutions

It is not set in stone that a business must only have either a physical or virtual account. Many businesses can get the best of both worlds by having both accounts.

In this case, businesses can use virtual for online and international transactions and physical accounts for cash management and specialised services or local banking needs.

Fincra

Ultimately, choosing between virtual and physical accounts involves:

- Carefully evaluating your business’s needs.

- Weighing the pros and cons.

- Seeking professional advice when necessary.

- Considering hybrid solutions that offer the best of both worlds.

One such solution is working with a payment partner like Fincra.

Fincra provides comprehensive payment solutions that can help businesses streamline their payment processes and enhance their chances of growth. By partnering with Fincra, businesses can enjoy the advantages of both virtual and physical accounts.

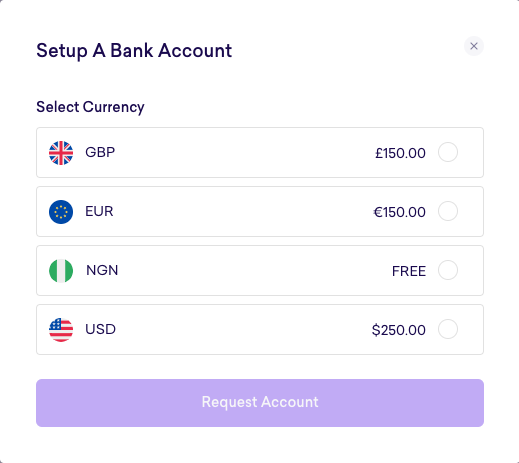

Fincra allows businesses to set up virtual accounts to collect customer payments easily. Businesses can get virtual accounts in USD, GBP, EUR and NGN.

These virtual accounts can seamlessly integrate with a physical account, providing a unified platform for managing and settling payments. Fincra’s virtual account solutions cater to online and offline payment scenarios, ensuring businesses can efficiently collect payments regardless of the channel.

If you’re looking for a reliable and efficient payment solution, Fincra offers virtual accounts to help your business streamline payment collection and enhance your financial operations.

Take advantage of Fincra’s services by creating an account today and leverage virtual accounts’ benefits for your business’s growth.