Since the Central Bank of Nigeria (CBN) released its guidelines on the operation and management of Agent Banking in 2013, this model of delivering financial services has become critical in the Nigerian financial sector. Agency Banking is fast dominating the ecosystem, especially in rural communities in Nigeria-although its impact also spreads across semi-urban regions.

Agency Banking overview

Agency Banking is branchless banking by a business, bank or financial institution that delivers permitted financial services through third-party agents to the end users.

It is important to note that we said ‘permitted’ financial services because Agent Banking has only been able to deliver basic financial services so far. Work and innovations in Know Your Customer (KYC) are ongoing to ensure that institutions can provide more sophisticated financial services like loans and insurance through agents.

In communities across Nigeria, Agency Banking has provided unlimited financial services to the unbanked population. With bank branches concentrated in urban centres, many of the rural population couldn’t access financial services, hugely affecting bank penetration.

Agency Banking has been particularly targeted at people living in rural, semi-urban areas and the unbanked segments of the urban population. Now, instead of taking on the cost of setting up brick-and-mortar branches and heavy traditional banking infrastructure, banks have been able to serve and reach more people across the country with the help of agents.

Commercial banks in Nigeria have used the Agent Banking model to sign on agents driving their retail banking operations. With this strategy, banks are penetrating more regions and communities at far less cost.

Banks in Nigeria are generally moving away from their traditional mode of operations while shifting towards Agent Banking and more innovative ways of delivering their services. A 2020 report from the International Monetary Fund (IMF) revealed that commercial banks in Nigeria shut down more than 200 branches and more than 600 Automated Teller Machines (ATMs) in that year.

The report stated that these reductions were due to a drop in branches caused by the rise in digital and mobile banking solutions. Since then, there have been continued surges in other models of financial transactions like mobile/digital and Point-of-Sale (POS) usage- The most common tool agency banking agents use in Nigeria is the POS machines.

Banks are one of many types of entities that operate Agent Banking. With its spread and overwhelming use cases, other financial institutions and businesses have started running this model of financial services.

Benefits of Agency Banking

All around, Agency Banking has been beneficial to everyone in the ecosystem. The economy, banks, financial institutions, businesses, agents, and end users.

While Agency Banking has helped banks expand their services more efficiently and quicker with fewer resources, this model of delivering financial services has helped financial institutions and other businesses diversify their products and add more revenue streams.

For the agents, Agency Banking has given them the opportunity to be gainfully employed, build capacity and learn new skills in information technology, cash management and relationship building.

White labelled solutions

The numerous benefits and potential of the Agent Banking model have led a fintech like Fincra to develop white-labelled solutions to help banks, financial institutions, fintechs, and businesses launch Agency Banking businesses.

What is white labelling

White labelling means buying a product or service from a manufacturer and rebranding and selling it as yours. In white labelling, the manufacturer uses the branding of the purchaser or retailer instead of its own. The end product appears as though the purchaser has produced it.

So when you see a fintech like Fincra describes itself as a white-label platform for Agency Banking, it simplty means that it has built solutions for banks, financial institutions, fintechs and businesses to launch their Agency Banking businesses.

With the rise and growth of financial services being distributed offline-that is Agency Banking, there is a need for infrastructure to make it easier for people to build agent networks.

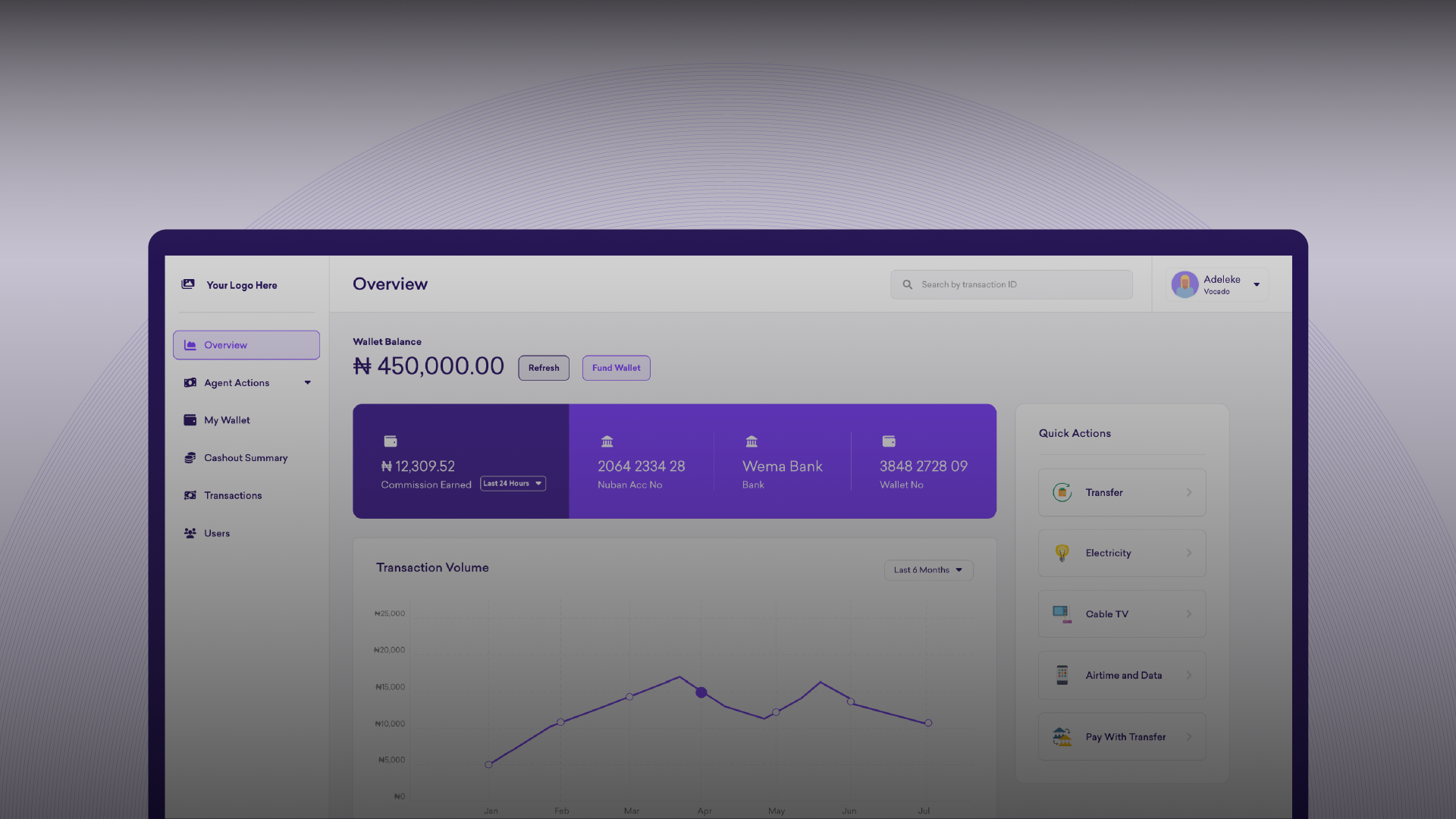

So one of the products Fincra has built is a white-labelled Agency Banking as a Service platform.

This Agency Banking as a Service is a platform where within one week, a financial institution, a business with a distribution network or a fintech can roll out a complete and robust Agency Banking network built on Fincra’s infrastructure without a single line of code.

Fincra’s CEO Wole Ayodele describes it as ‘Shopify for Agency Banking’. Ayodele, Founder of Fincra said in an appearance on the finance and technology podcast, The Open Africa Podcast;

“Whether you are a bank (commercial or microfinance bank), a super agent, an MMO, a PSB, a fintech or a business that has a distribution network, and you want to go into Agency Banking. Fincra provides a white-label platform that enables you to go live in one week with all the tools to run an Agency Banking as a business.”

APIs

Fincra also provides Agency Banking solutions via APIs to power an agency network. Fincra has built APIs that power all products you will see on agency networks, like cashout services, Virtual Accounts, transfers, Bills payment, airtime, betting, insurance, etc.

Businesses that can use Fincra’s white-label solution

Fincra operates this white-label model as Agency Banking as a Service. This service also works like embedded finance because it applies to non-traditional finance businesses with a distribution network, like a fuel station with 500 branches or a Fast Moving Consumer Good retail store with many branches. These businesses could have agents at several locations where cash is being generated.

Fincra provides a platform that automates the entire process; businesses don’t have to build any line of code; all the products come inbuilt along with the SDKs for POS devices. These are offered as a platform for different business categories.

Benefits of Fincra’s white-label solutions

Fincra understands how hard it can be to develop and launch Agency Banking businesses, so it has developed its white-label solutions to help businesses, platforms, banks, and fintechs save time and resources and focus on sales and speed to market.

-

Cost Saving

Business entities can leverage this solution to save the cost of building a new technology stack. Entities do not have to hire experienced developers, splash money on cloud storage etc. With Finra, entities can avoid these costs while setting up agent networks.

-

Business growth

The white labelling model is not only beneficial to startups. Established businesses like traditional banks and big fintechs can add another stream of revenue and experience growth by using solutions from white-label Agency Banking solutions.

-

Streamline focus

With Fincra’s white-label solutions, entities can only focus on branding, marketing and other critical aspects of their operations instead of worrying about the infrastructure and technical aspects of the Agency Banking products.

Why Fincra

If you are a bank or an entity looking for white-label solutions to build an Agency Banking network, these are three reasons you should consider using Fincra;

-

Compliance

Compliance has to be your top priority when choosing a white-label platform to work with to launch your branchless strategy. The white-label provider should have all the required licences and certifications. Fincra has Approval in Principle (AIP) from CBN for a Payment Service Solution Provider (PSSP) Licence.

-

Security

Security is so critical in the finance industry; dealing with people’s money is sensitive, which is why there are a lot of regulations to ensure that white-label platforms are compliant with these regulations. We take security seriously at Fincra. All funds are safe and can be accessed for transactions at any time.

-

Integration and support

White-label platforms are supposed to make things as seamless as possible for businesses to launch Agency Banking products, so integration support is essential when considering a partner to work with. Fincra’s integration processes are as automated as possible.

Businesses also need a lot of support during the integration processes, and Fincra has a fantastic support team to walk you through the process.

Conclusion

White labelling as a product development model is expected to grow with entities looking to give customers an integrated experience.

With Fincra, every business, fintech, and bank can have a successful Agency Banking product, giving millions of customers access to financial services.

Let’s talk about your Agency Banking plans or get started yourself.