Introduction

Virtual accounts have been one of the inventions in modern payment technology, reshaping the payment landscape for businesses.

Among their slew of benefits, one standout advantage is the seamless tracking of payments enabled by unlimited virtual bank accounts.

This article delves into the world of unlimited virtual bank accounts and explores how they can elevate businesses to new heights.

Understanding virtual accounts

A virtual bank account is a virtual/digital account that works like a regular bank account.

While the definition may suggest a singular difference, the benefits and features that set virtual accounts apart are numerous.

Individuals and businesses can receive payments, send transfers, and manage finances without stepping into a physical bank.

A pivotal use case for virtual accounts is payment collection, especially with the evolving trend of bank transfers.

In regions like Nigeria, where bank transfers dominate the payment landscape, businesses find virtual accounts indispensable for maximising sales potential.

These accounts facilitate payment collection and streamline the often cumbersome manual reconciliation process.

Unlimited virtual bank accounts

Consider a scenario where a business relies on a single account to collect customer payments—tracking and reconciling such payments would pose significant challenges. E

Enter unlimited virtual bank accounts, a game-changer that allows businesses to generate virtual accounts on demand.

For instance, imagine a logistics company needing to confirm payment post-delivery. With unlimited virtual accounts, they can effortlessly generate a unique account for each customer, simplifying the confirmation and reconciliation process.

Introducing these unique virtual International Bank Account Numbers (IBANs) for each customer further adds a layer of accuracy to transaction tracking.

The utility of unlimited virtual accounts extends beyond businesses; financial institutions and fintechs also benefit from this feature. From lending and loaning to payment providers, saving, and investment fintechs—virtually any financial service can leverage the advantages of unlimited virtual bank accounts.

Benefits of unlimited virtual bank accounts

Precise tracking

Unlimited virtual bank accounts empower businesses to monitor transactions at a granular level, offering valuable insights into customer behaviour, spending patterns, and overall financial health.

Customer customisation

Businesses can provide personalised virtual IBANs when they can generate unlimited virtual accounts. This personalised account enhances the customer experience, instilling a sense of control and transparency over financial interactions with the business.

How to get unlimited virtual bank accounts

Choosing the right provider is the first step

Fincra offers Virtual Account as a Service, providing businesses and financial institutions access to unlimited virtual bank accounts tailored to their needs.

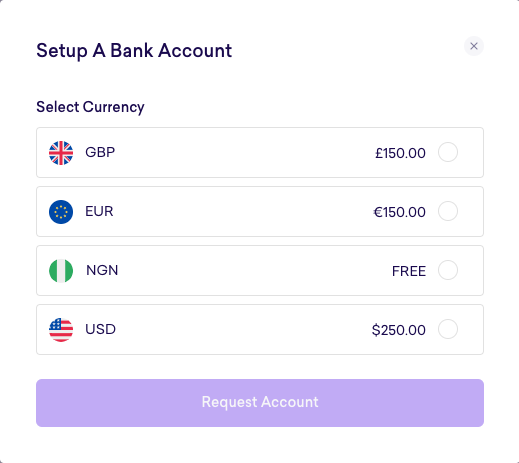

With Fincra, businesses and financial institutions can quickly generate virtual bank accounts from their dashboards or via APIs at any time and for any business purpose.

Access the Fincra merchant dashboard and our APIs by creating a free account.

Aside from creating unlimited virtual accounts, businesses can collect payments in USD, EUR, GBP, and NGN, enabling them to cater to a global customer base with Fincra.

Conclusion

Incorporating unlimited virtual bank accounts with unique virtual IBANs is not merely a step forward—it’s a leap towards financial freedom and success in the contemporary business landscape.

By embracing this technology, businesses can meticulously track every transaction, ensuring no financial detail goes unnoticed. The future of banking is here—seize it to empower your business with the control and insight it deserves.