Introduction

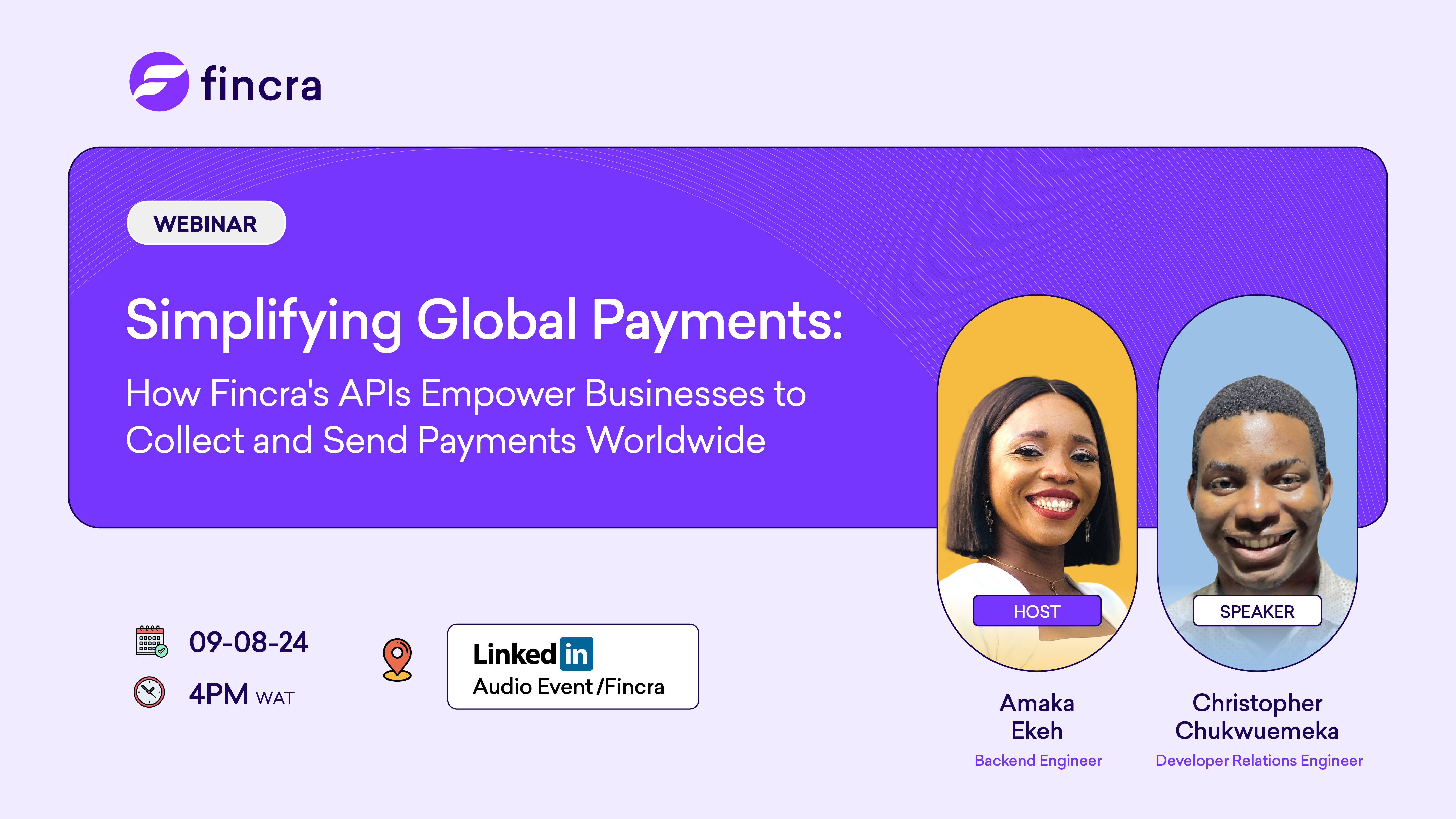

On Friday, August 8, 2024, we held a Linkedin audio event where Fincra’s Developer Relations Engineer Christopher Chukwuemeka spoke on ‘Simplifying Global Payments With Fincra APIs.

During the session, he discussed some of the problems businesses and developers face and how Fincra solves them. He also spoke about Fincra’s APIs and how they enable global payments.

Here are the talking points from the event.

1. Payment problems businesses face and how Fincra solves them

During the session, Christopher discussed some of the common issues businesses face regarding payments and how those issues become a thing of the past when businesses choose Fincra as their payment partner.

Here are some of the issues he highlighted –

- Lack of trust

Businesses need to trust that their payment processors will always be functional when their customers want to make a payment. Nobody likes downtime, which is why at Fincra, we take pride in our 99.95% uptime.

He also discussed how it is very important to businesses that they can trust that their customers’ money is safe. It is hard to build up a good reputation but easy to lose one, so businesses have to take great care and do thorough research when picking a payment processor. Alternatively, they can skip to the end of that process and just choose Fincra.

- Limited payment options

Christopher also highlighted a lack of adequate payment options. Customers and potential customers have many different payment preferences, and a business needs to be able to accommodate them.

“To be able to expand, you need to be able to accept payments from new market segments,” he said. This is only possible when you partner with a payment processor that pushes the limits with regard to expanding its reach.

Fincra enables businesses to accept payments via cards, bank transfers, PayAttitude, Mpeso, Mobile money, etc. Fincra has so many payment options so that your customers always have a way to pay you.

2. Problems developers face with integration and how Fincra solves them

- Complexity

Being a developer relations engineer, this is a topic Cristopher knows all too well. He spoke about how it’s very important for developers that the integration process is not complex. Developers want a stress-free process when integrating your payment gateway into their systems, which is why we prioritised that at Fincra.

We designed our APIs in the common API REST structure, constantly revamp our documentation, and provide SDKs which make the integration process much easier. “With our SDKs, even a non-developer can integrate our payment gateway,” Christopher said proudly.

When you combine our SDKs with our thorough API documentation, it’s no wonder why developers love our APIs.

We also have a developer hub where you can talk directly to Fincra developers in rare cases of integration issues.

- Security

Security is a big deal in this industry, more so than in other industries, because there is money at stake. Developers are very concerned about security, which is why our APIs come with API keys. These keys ensure that the request is coming from you; they are essentially an authentication mechanism.

We also have IP whitelisting, which takes it a step further. With this, if someone has your authentication credentials but the request is not coming from your IP address or server, the request will be rejected. This added security measure reassures developers that they have nothing to worry about when using our technology.

- Scaling

Developers need to be sure that your systems can handle their requests regardless of the scale. At Fincra, we have infrastructure and cyber experts working around the clock who make sure our services are optimal at every point.

3. Fincra’s use cases

During the session, Christopher also spoke about some Fincra use cases. Some of the scenarios he touched on include:

- Business operations

“You don’t always have to do an API integration to get access to Fincra’s products. You can sign up to Fincra like a regular business and use us for business operations”, he said. For example, a small business wants to create an account to manage business funds, receive money from customers, and pay contractors.

Fincra meets this demand with our virtual account technology. The business can easily create and manage multiple currency accounts. They can receive payments from customers through various channels such as payment links, card payments, mobile money, and bank transfers. Additionally, they can pay contractors directly from their business account, streamlining their financial operations.

- Virtual account creation

For this use case, Christopher used an example of a fintech startup that wants to offer its users the ability to create virtual accounts, deposit funds, and process withdrawals. By utilizing Fincra’s virtual accounts API, the fintech can provide each user with a virtual account. Users can deposit funds into their accounts via card payments, bank transfers, or mobile money. They can also process withdrawals seamlessly.

- Money remittance

Fincra is an attractive destination for developers building money remittance applications because of our multicurrency capabilities. “Our multicurrency accounts are a fan favourite at the moment”, Christopher said. This is only the case because nobody on the market does multicurrency accounts quite like Fincra.

With Fincra’s cross currency transfer API, the company can offer secure and efficient fund transfers across borders. Customers can send money to different countries using various payment methods such as card payments, bank transfers, and mobile money.

- E-commerce

To demonstrate how E-commerce businesses can benefit from integrating Fincra into their systems, Christopher used an example of a retailer who wants to simplify the checkout process and offer multiple payment options to customers.

Fincra’s checkout solution allows the retailer to integrate a seamless payment gateway on their website. Customers can choose from various payment methods, including card payments, mobile money, and bank transfers. This not only enhances the customer experience but also reduces cart abandonment rates and increases sales.

4. Businesses that Use Fincra

The discussion would not have been complete without Christopher mentioning some great businesses using Fincra to simplify their global payments. When talking about businesses that trust Fincra to process their payments, he mentioned well-renowned fintech companies like Nala, LemFi, and Eversend. He also highlighted thriving remittance companies like Taptap Send and Cleva.

All these great businesses trust Fincra to process payments; you should too.

Click here to get started with Fincra.