The challenges associated with cross border payments in Africa have pushed Fincra to innovate and provide solutions.

The benefits of cross-border payments for businesses are numerous. For a business to truly scale out of its base and expand its networks of customers, employees and partners, it must have access to an efficient system of cross-border payments.

For African businesses to tap into the growing global business market, they need access to infrastructure that can provide secure, fast and convenient cross-border payments.

However, despite the technological advancements in payments, enormous challenges are still plaguing cross-border payments across Africa. Complexities around Africa, including different currencies and economies, make cross-border payment strenuous. There’s also the challenge of every other country having a different payment system. These huddles are particularly frustrating for businesses as making or receiving payments across borders is a necessary activity.

Moving money across borders requires transferal through the relevant domestic systems, which most have different working hours and are in different time zones. For some systems, the funds are pathed through several banks before reaching their destination.

These processes attract significant bank fees at each payment gateway making cross border payments expensive. Regulatory costs and currency conversion costs also add to the price of a cross-border transaction.

The complex nature of cross border payments also causes transactions to be slow. The traditional cross border payment method typically takes up to five days in some cases.

As the process gets slower during a cross border transaction, the risk of a security breach increases. This delay does not exude confidence in consumers who spend days being anxious about every transaction.

Another considerable challenge in cross border payment is the lack of transparency in pricing, cost and deductions involved with every transaction.

Fincra’s Solution for cross-border payments

The challenges associated with cross border payments in Africa have pushed new fintech companies to innovate and provide solutions. Making cross border payment as easy as sending a text message is the overall mission of one of those fintech companies, Fincra.

With Fincra, businesses can make cross-border payments globally with ease and efficiency, which can help them scale. Fincra has designed its suites of payment tools to help businesses with the most critical element of their operations: payments.

Receiving cross-border payment

For a business, selling across borders opens the opportunity for additional revenue, and this is impossible without a payment system to allow payments across borders.

With Fincra, businesses across Africa can receive payment globally with our Collections. Fincra provides low-cost and dependable payment options like our Virtual Account features, which allow businesses to accept payments in USD, EUR, GBP, and NGN. With this supported currencies, businesses that use Fincra can accept payments from customers in the United States and Europe, the United Kingdom and Nigeria. Other currencies will soon be available on Fincra, expanding options for businesses selling across borders.

While receiving payments with Fincra, businesses get to receive their total value with no hidden fees.

Making cross-border payment

Aside from receiving payments from abroad, businesses also need to make cross-border payments to suppliers, partners, investors etc. This form of payment is called Business to Business (B2B) cross-border payments.

B2B payment is the largest segment within cross-border payments worldwide and is currently valued at $900 billion and estimated to reach $1.6 billion by 2028, according to Vantage Market Research. Tapping into this boom is critical for businesses across Africa.

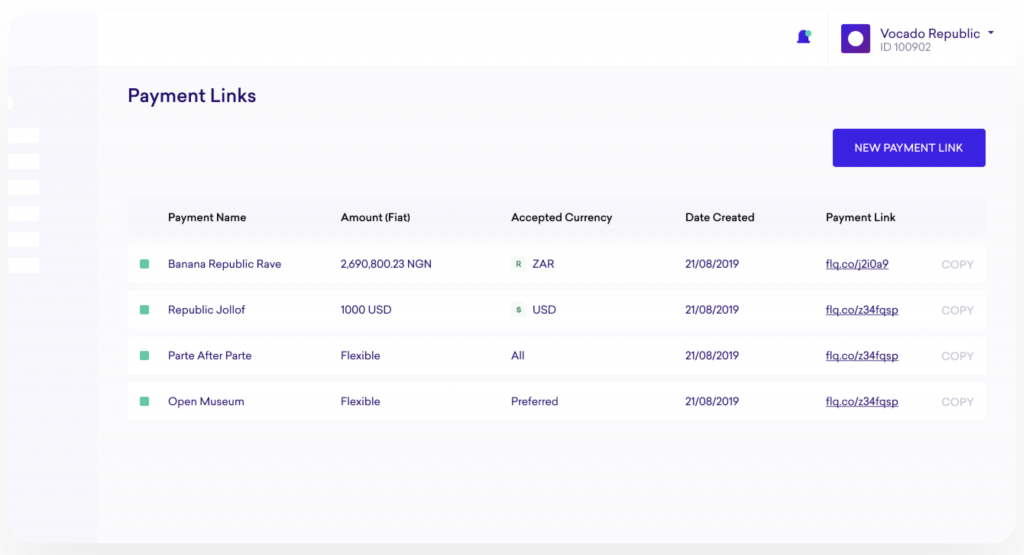

Fincra’s Payout product can help businesses make instant cross-border payments in several currencies, including EUR, GBP, USD, GHS, KES, NGN, ZAR, etc.

From the Fincra wallet, where payments are settled, onboard merchants can make Payouts to beneficiaries who receive the value in their preferred currencies. Currency conversion happens automatically as the merchant sends money without any hassle.

APIs

For fintechs, e-commerce businesses, banks, or businesses that make frequent payments, Fincra has easy-to-integrate APIs to get access to all Fincra products. Fincra designed the APIs with Developers or anyone involved in building payment infrastructure in mind.

There are also so many payment needs that businesses can do with Fincra’s payment tools, APIs-including Wallet Management, Quote Generation etc.

Conclusion

The overview of all of Fincra’s offerings is to make cross-border transactions easy for businesses. Businesses are the heart of everything we create at Fincra. Helping in the movement of value is Fincra’s contribution to the efforts to make Africa prosperous.

Fincra has delivered these cross-border solutions for businesses across sectors; e-commerce, hotels, schools, fintechs, banks etc.

It’s an exciting era for businesses across the continent. Get in touch with our Sales team to learn more or get started straightaway.