Introduction

With diverse customer preferences for online payments, it has become important for businesses to consider and accommodate them by partnering with a payment service provider.

Fincra is that ideal payment partner.

At Fincra, we proactively address payment challenges so our merchants can focus on their business.

By keeping up with local and international payment trends, we develop payment products that make it easy for our merchants to collect payments.

This approach guided the development of Fincra Checkout, a versatile solution with various payment preferences.

This article will explore the various payment methods available through Fincra Checkout.

Available payment methods on Fincra Checkout

- Debit/Credit Cards

- Bank Transfers

- M-Pesa

- Mobile Money

- PayAttitude

Debit/credit cards

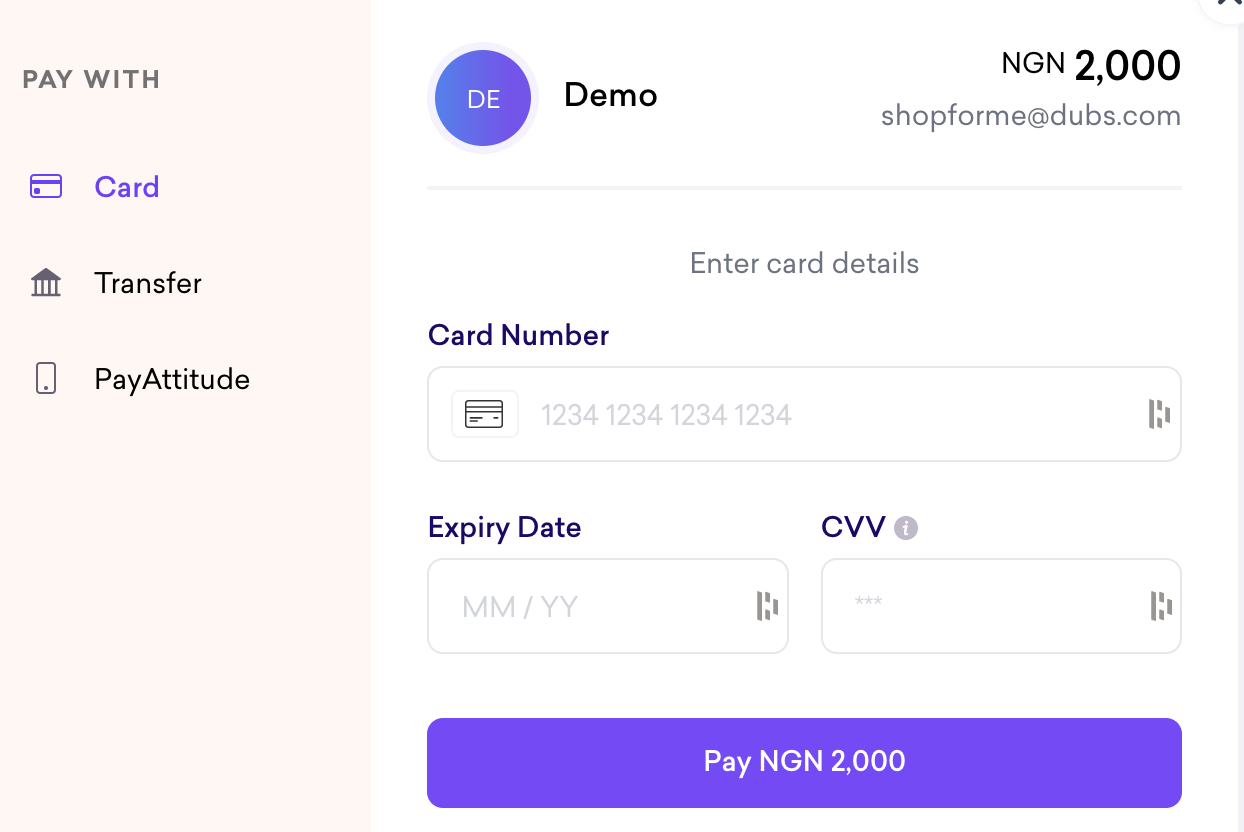

Card payments are the most popular type of digital payment worldwide. The Fincra Checkout allows customers to make highly secure card payments using their bank cards.

Your customers never have to worry when inputting their card details to make payments for your products or services because Fincra is PCI DSS compliant, which means that we have attained the highest standard of security audit as a payment processor.

Also, Fincra has a 3D Secure payment gateway. When your customers try to make a card payment, the system will attempt to ascertain that the transaction is legitimate, usually by requesting a one-time password (OTP).

This capability provides an additional layer of authentication for credit and debit card transactions to protect your business and customers from fraud.

Fincra powers card payments in NGN, UGX, KES, and GHS with USD and other foreign currencies will be available soon.

Bank transfers

There is a big ‘Pay with transfer’ culture in this part of the world, and many of your customers prefer to make bank transfers rather than use any of the other payment options.

As highlighted in a 2023 report, 48.5% of Nigerians use bank transfers as their preferred payment method.

This method allows customers to complete payments even when not using their bank cards via their bank app or USSD.

At Fincra, we thoroughly analyse the payment landscape when building our products to equip our merchants with everything they need to succeed.

For this reason, Fincra’s Checkout enables businesses to collect payments effortlessly through bank transfers.

This capability is powered by virtual accounts generated by Fincra, facilitating a streamlined payment collection process for these businesses.

Fincra has virtual accounts in NGN and foreign currencies like EUR, GBP, and USD.

M-Pesa

With M-Pesa, your customers need only a mobile device and a SIM card to pay. M-Pesa is a mobile banking service introduced in Kenya as an alternative way for the country’s population to access financial services.

M-Pesa has given more people access to financial services. Many people without bank accounts but mobile phones can deposit cash with an M-Pesa agent and start making digital payments with SMS messages; it’s as easy as that.

M-Pesa crossed the 50 million user mark last year, and it’s showing no sign of slowing down because of its ease of use and financial inclusion.

With Fincra’s Checkout, you can satisfy a broader range of customers by accepting M-Pesa payments.

Mobile money

Mobile money is a method of payment that utilises mobile money accounts and is facilitated by a network of mobile money agents.

This payment service is provided by mobile network operators like MTN and Airtel or entities that partner with mobile network operators.

The only requirements for mobile money are a mobile phone and a registered phone number; hence, it fosters financial inclusion, as people without bank accounts can make digital payments using mobile money.

The unbanked can deposit cash with mobile money agents and then use mobile money accounts like MTN MoMo to pay for goods/services online.

As a business, you will have different types of customers who want to pay for your products and services.

At Fincra, financial inclusion was a priority when we built the Fincra Checkout, which is why it is so thorough and caters to so many different types of customers.

PayAttitude

PayAttitude is a popular payment method because you only need your phone number to make digital payments.

Payattitude Global is an incorporated entity with a license to operate as a payment service, which was granted by the Central Bank of Nigeria (CBN) in 2013. In addition, PayAttitude’s payment gateway is compliant with EMV and PCI DSS standards, so you have nothing to worry about regarding security.

PayAttitude also owns a patent that enables it to use innovative technology and processes which allow phone numbers to be used for different transactions available across ATM channels, POS channels, and the Internet.

Fincra’s Checkout allows you to accept payment from PayAttitude, further evidence of our commitment to giving our merchants all the financial solutions they need to succeed in this economic climate.

Conclusion

Providing avenues for all customers to pay with their preferred payment method is sometimes what it takes to turn one-time customers into recurring customers.

At Fincra, we do our best to cover all bases so our merchants can regularly give their customers an optimal payment experience.

Create a free account here to provide your customers with various payment options on Fincra Checkout.