In Nigeria, this financial service model has solved problems for the millions of unbanked people, especially in rural areas.

Since agency banking emerged as a strategy to improve financial inclusion in less economically developed countries in the mid-2000s, this model of delivering financial services has continued to spread in Africa. From M-Pesa’s successful outreach in Kenya to a slew of fintech startups that have aimed to replicate this model, agency banking services are becoming popular on this side of the world.

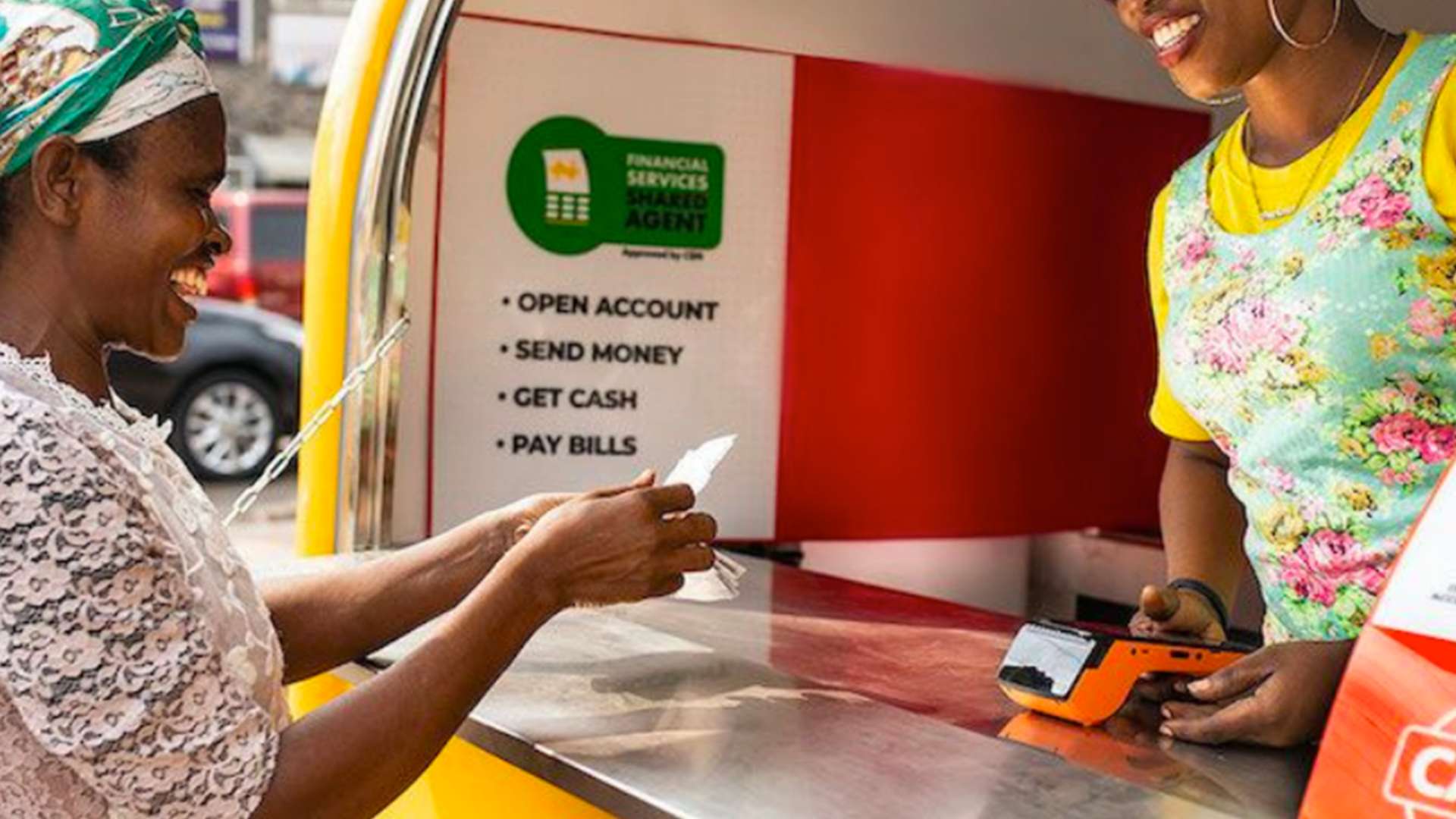

Agency banking is a financial service that delivers to the last mile using human agent networks or merchants. These agents perform services on behalf of an entity like Fincra. The most common tool agency banking agents use in Nigeria is the point-of-sale (POS) machines.

In Nigeria, this financial service model has solved problems for the millions of unbanked people, especially in rural areas. Thanks to agency banking, access to financial services in a largely poor mass market have deepened. With the cost and complexities of setting up and running branches, the traditional banking system has maxed out on its reach, causing financial services to elude millions of people living in rural areas.

In Nigeria, startups, telecoms and even traditional banks have used agency banking to plug the obvious gaps for the unbanked to significant success.

Two factors have fuelled this growth;

1. Relative ease in becoming an agent

Getting to become an agent that delivers agency banking services is easy. The low barrier entry has seen anyone with a shop or a mobile set-up serve as an agent for a bank or mobile payments company like Fincra. Other existing small-time traders with any set-up have also become double agents with POS devices. EFInA in June 2020 revealed in a study that 60% of Nigerian agent outlets operate agency businesses alongside their regular business.

Aside from the low barrier of entry, these agents can also serve multiple entities. A single agent can operate several POS machines of different companies because they do not have exclusive arrangements with anyone.

2. High cost of traditional banking

Banks are expensive to operate. The cost of building a new bank branch in Nigeria and the monthly expenses that include ATM, security, electricity etc., is vast and unsustainable for any business. Instead, agency banking services have been used to serve the unbanked in rural areas. This has been a key factor in the growth of the agency banking business in Nigeria.

Agency Banking with Fincra

Despite the significant growth of agency banking in Nigeria, there is still a lot to be done. Agency banking is still primarily cash-driven, and there is a growing need for the services to go beyond cash-in-cash-out.

These value-added services are what Fincra offers with its agency banking product. “One of our key offerings is helping businesses to launch agency banking business through our platform, encouraging financial inclusion,” Fincra CEO Wole Ayodele said.

With Fincra’s agency banking service, an agent can make a funds transfer, airtime recharge, bills payment and subscriptions.

Ready to get your agency banking business up and running? Contact us today to get started.